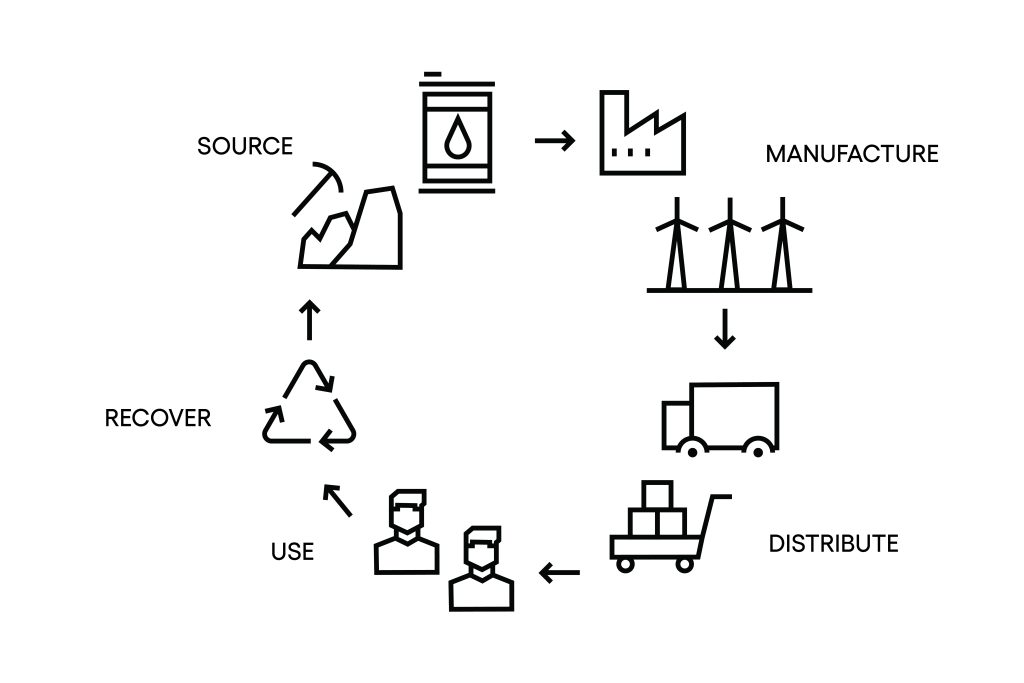

Müncon covers the whole battery value chain. Thus, we offer holisitic financial modelling along the value chain.

At the beginning of the value chain, we have experience in calculating and implementing mining projects (more here). Furthermore, Müncon works with its partners on establishing mines and sourcing raw materials. For new batteries, we model lifetime value and optimization of pricing.

Once Electric Vehicles reach their End-of-Life (typically after around 10 years), the batteries are reused in. After another 5-10 years, the batteries are technically unsuitable for futher applications. In this case, these batteries have to be

recycled.

With multiple customers,

we have modeled the investement costs for entering the market of second life batteries and all related processes: From costs of second life batteries for purchase, transport, to pricing of

whole second life battery systems.

Business Model Calculation Tool

Müncon has developed a tool for detailed calculations of all these parameters. The tool thereby dynamically adjusts to the available number of used batteries – depending on capacity and type.

Recycling Cost-Breakdown Tool

For recycling, we also created a tool in order to calculate the overall finances for recycling activities – as the output of such a recycling plant is raw material, the whole operation must be profitable depending on the day-to-day material prices. In turn, the financial model depends on the input of batteries.

Cost-Out Consulting

For existing projects, we consult our clients in optimizing the cost structure of second life projects, optimizing sourcing of first and second life batteries as well as raw materials. At the beginning of the value chain, we help in cost-optimizing mining activities.

Networking

Müncon also supports you in connecting with our existing network in battery 2nd life and battery recycling industry.

Still missing something? We are always adapting, and our team would be glad to help you with any of your concerns.