The current market design in Europe uses zonal pricing methodology for wholesale electricity pricing. Zonal pricing means that the prices within a region i.e., a bidding zone, are homogenous.

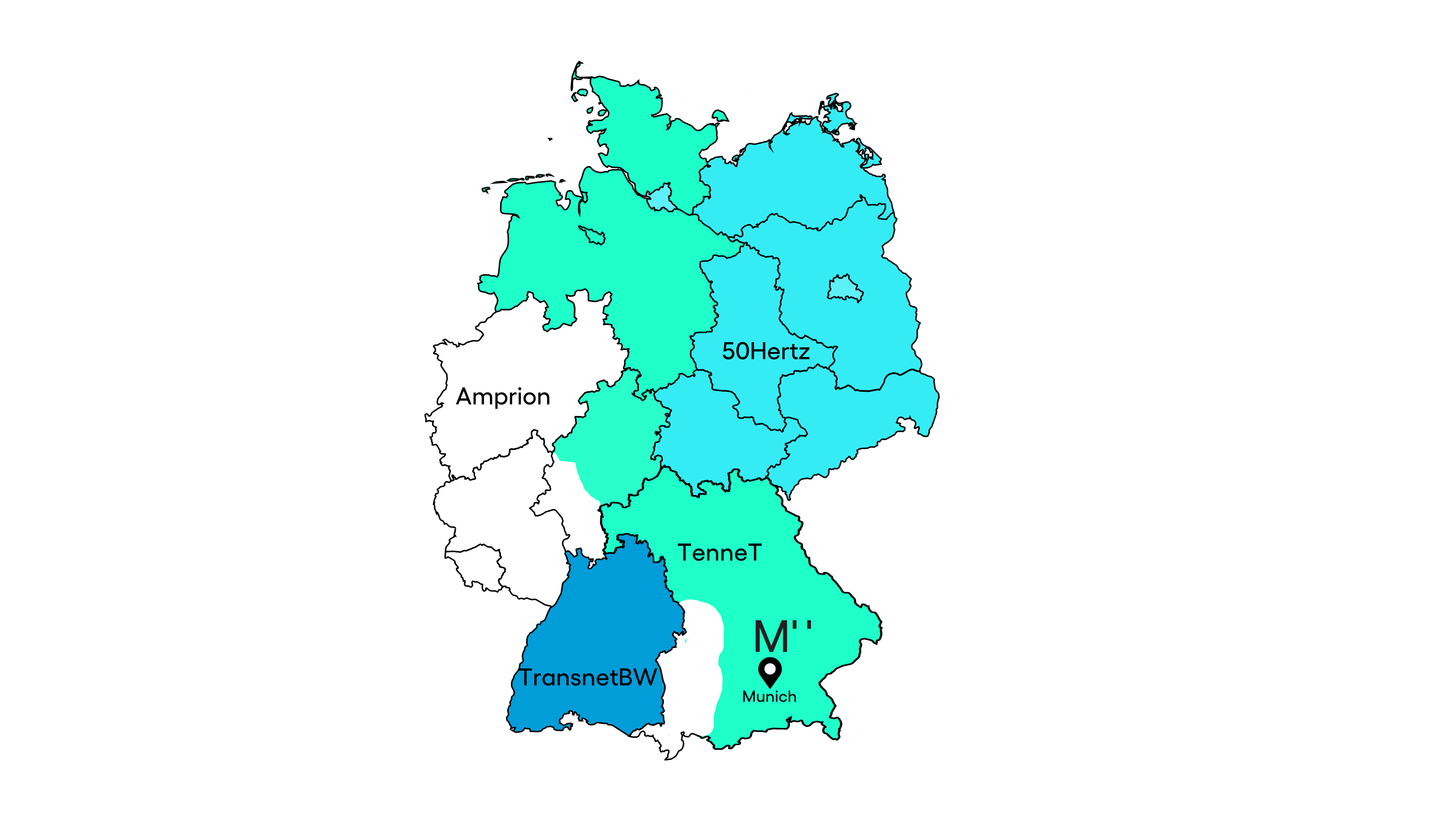

In Europe, bidding zones generally follow national boundaries, Germany being a notable exception, where the country is internally divided into 4 distinct zones. The German electricity market is managed by 4 distinct Transmission System Operators (TSO):

Generally, the price difference between different bidding zones allows for cross-zonal trade of electricity. That being said, the cross-zonal trade volume is limited by the cross-zonal transmission capacity – directly or indirectly – between zones.

In the case of the Germany electricity market, due to legislative interventions, the prices in the 4 bidding zones are coupled and homogenous – barring electricity trade from occuring within the country. It is worth mentioning that, Luxembourg’s bidding zone is also price-coupled with Germany.

The network capacity within a bidding zone is assumed to be limitless for perfect electrical flows and is basically treated as a ‘copper plate’. But this is not true, as intra-zonal network constraint is a significant limiting factor. This is especially the case in Germany – where deploying large transmission corridors has emerged as a challenge over the years.

In order to counter that, the TSOs in the German electricity market use ‘Redispatch’ to alter the scheduled commercial flows within their bidding zones and compensate the market players for their losses or additional generation.

Further, Germany has made an amendments to the laws regarding congestion management, by introducing ‘Redispatch 2.0’.

From 1 October 2021 onwards, the TSOs will be allowed to also redispatch renewable power plants in order to prevent or remedy grid congestions. As long as the power plant exceeds 100kW installed capacity, regardless of whether it is a renewable or conventional powerplant, it is allowed to redispatch.

The new law does not change the fact that redispatch for conventional power plants occurs first, as the feed-in priority of RES still hold precedence over conventional powerplants.

In any case, operators of these powerplants have to be compensated for reducing or increasing their power generation, which may increase power prices for consumers.

Electricity Market Sequence

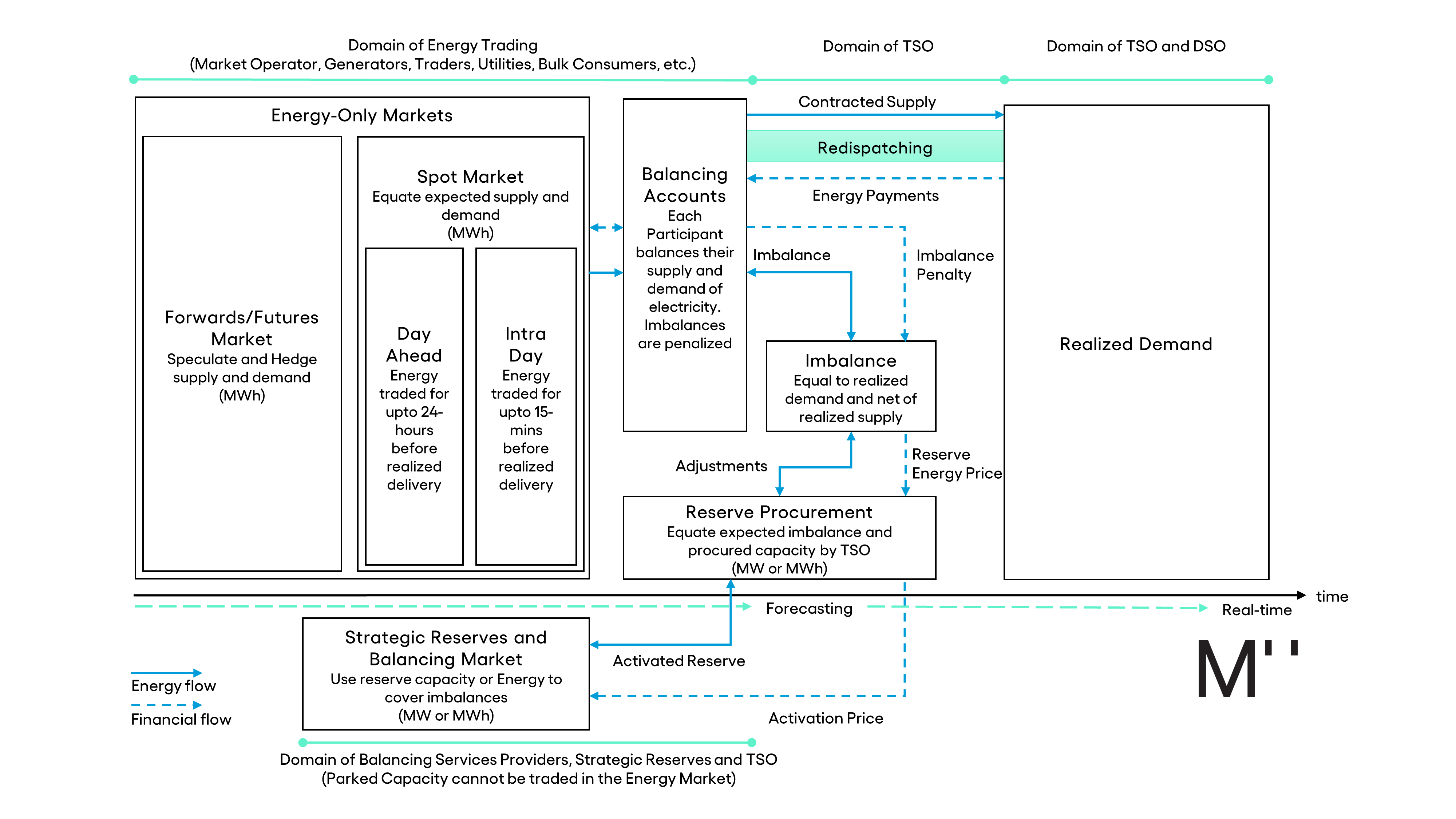

Before the gate closure of the German electricity market, the energy is allowed to be traded readily in the marketplace (energy-only markets), and may change multiple hands before the contracts are realized – dependent on how liquid the market is.

The two strategies to trade electricity are:

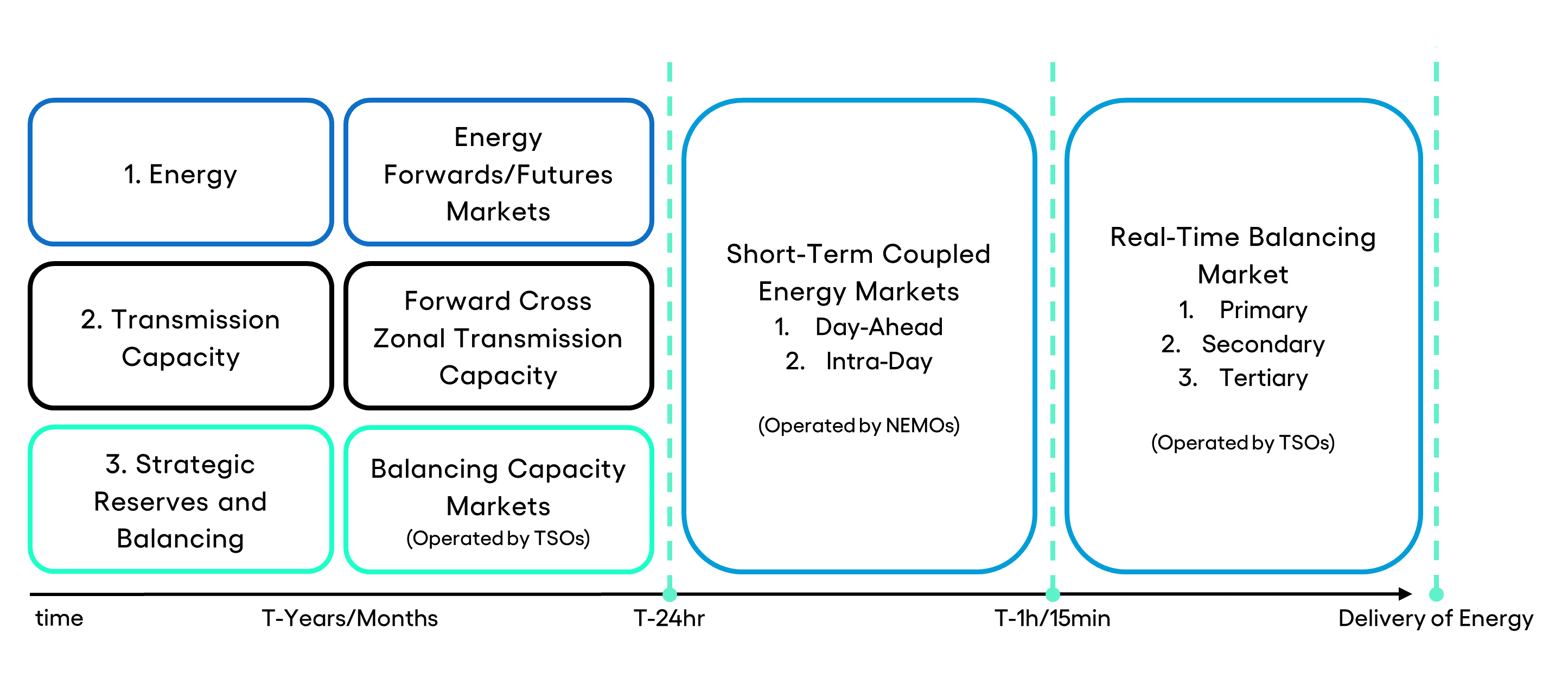

The different components of electricity i.e., energy, transmission capacity and reserves/flexibility can be traded to match supply and demand.

The physical or purely financial trading of electricity starts years in advance in the forwards markets. These trades are allowed to be made until one day (T-24h) before the delivery of electricity. These markets are used as a hedging mechanism for consumers and producer, and used to safeguard from unpredictable variability in the short-term markets.

Short-term supply of electricity is generally sourced from energy-only markets in Europe. Which are sub-divided into: day-ahead (see 2a) and intra-day market (see 2b).

These markets are operated by a Nominated Energy Market Operator (NEMO). These markets are considered to be coupled. This means that the order placed in one bidding zone can be served by the bids in another bidding zone, provided the transmission capacity is available.

Price differences between bidding zones therefore balance out, as long as interconnector capacities are not congested and available for allocation. Thus, an efficient utilization of cross-zonal interconnector flows contributes to price convergence across market areas.

The markets operate on either auctions and/or continuous trading. For instance, day-ahead markets in Germany are auction-based, where bids for the following day can be submitted by 12pm on any day of the year.

Differentiated standard products are bid, including full hours and standard block-bids. The auction results are calculated within 40 minutes and results published by 12:40pm for the following day. The market clears when the supply matches the demand; the market-clearing price is systematically determined by the intersection of supply and demand bids – sorted by price. The clearing prices are bounded between -500€/MWh and 3000€/MWh.

The intraday market distinguishes between the intraday auction and continuous trading on the intraday continuous market. Continuous trading has already been introduced in 2011. The opening auction for 15-minute contracts has been held since December 2014 and takes place all year round at 3pm on the day before delivery.

The auction enables market participants to optimize on a quarter-hourly basis following the hourly optimization on the day-ahead market. As a supplement to continuous intraday trading, the opening auction is designed to concentrate market liquidity and to create a first reference price for the continuous trading period. The auction design is similar to the day-ahead auction, with the price of the intraday auction ranging from −3000€/MWh to 3000€/MWh.

Continuous trading is based on a “pay-as-bid” auction format, which means that there are no uniform prices for the products, but rather different prices for the same product depending on the supply and demand at the time of the trade. Since 2017 in Germany, it is possible to execute trades up to 5 minutes before delivery, within one TSO area.

It is worth mentioning that, financial and physical flows of electricity trade are not strictly linked and only the realized demand needs to be generated at the power stations. Moreover, the physical flow of electricity is governed by the laws of Physics and needs to considered when dispatching in real-time. TSOs are responsible for managing the dispatch and system stabiltiy.

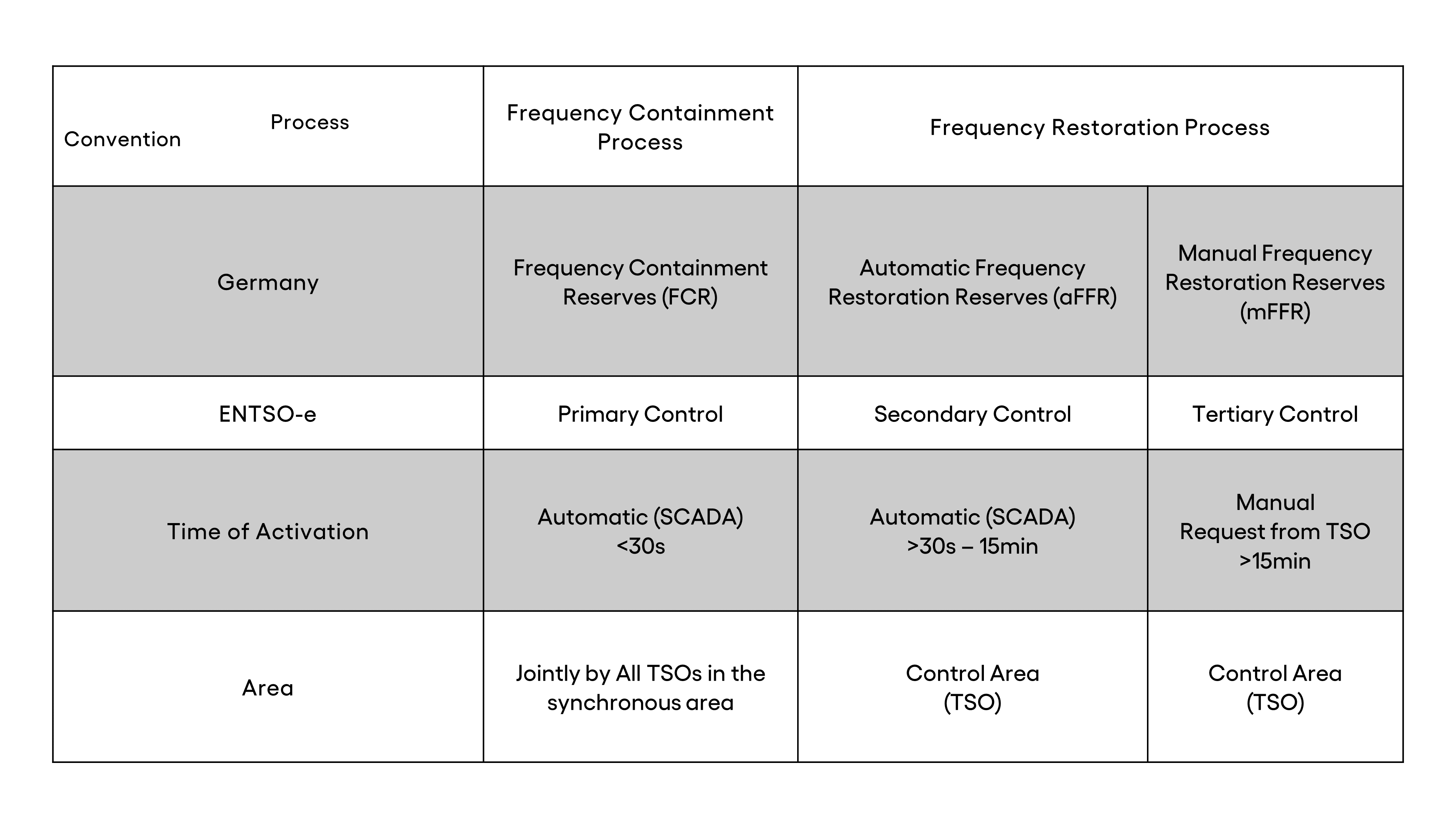

The primary function of the balancing market is to maintain the frequency of the electrical grid at 50Hz – ensuring reliable operations and security of supply. This is directly linked to the functional responsibilities of TSOs.

The TSO is the sole organizer and the buyer of balancing capacity and energy within its pertinent control area. Due to the monopolistic nature of this market, it is highly regulated under EU and national regulations. Balancing Service Providers (BSP), the market participants with reserve-providing units or groups, provide their balancing capacities to the TSOs.

TSO estimates the maximum expected demand over the next year(s); pre-qualifies the BSPs; procures and dispatches the required reserves; and settles the payments. Therefore, a high degree of coordination and communication with the TSOs can be expected while operating in these markets.

It may be noted that, the amount of procurable balancing capacity is pre-determined and is calculated by the balancing reserve requirements of different geographical regions within the European energy market.

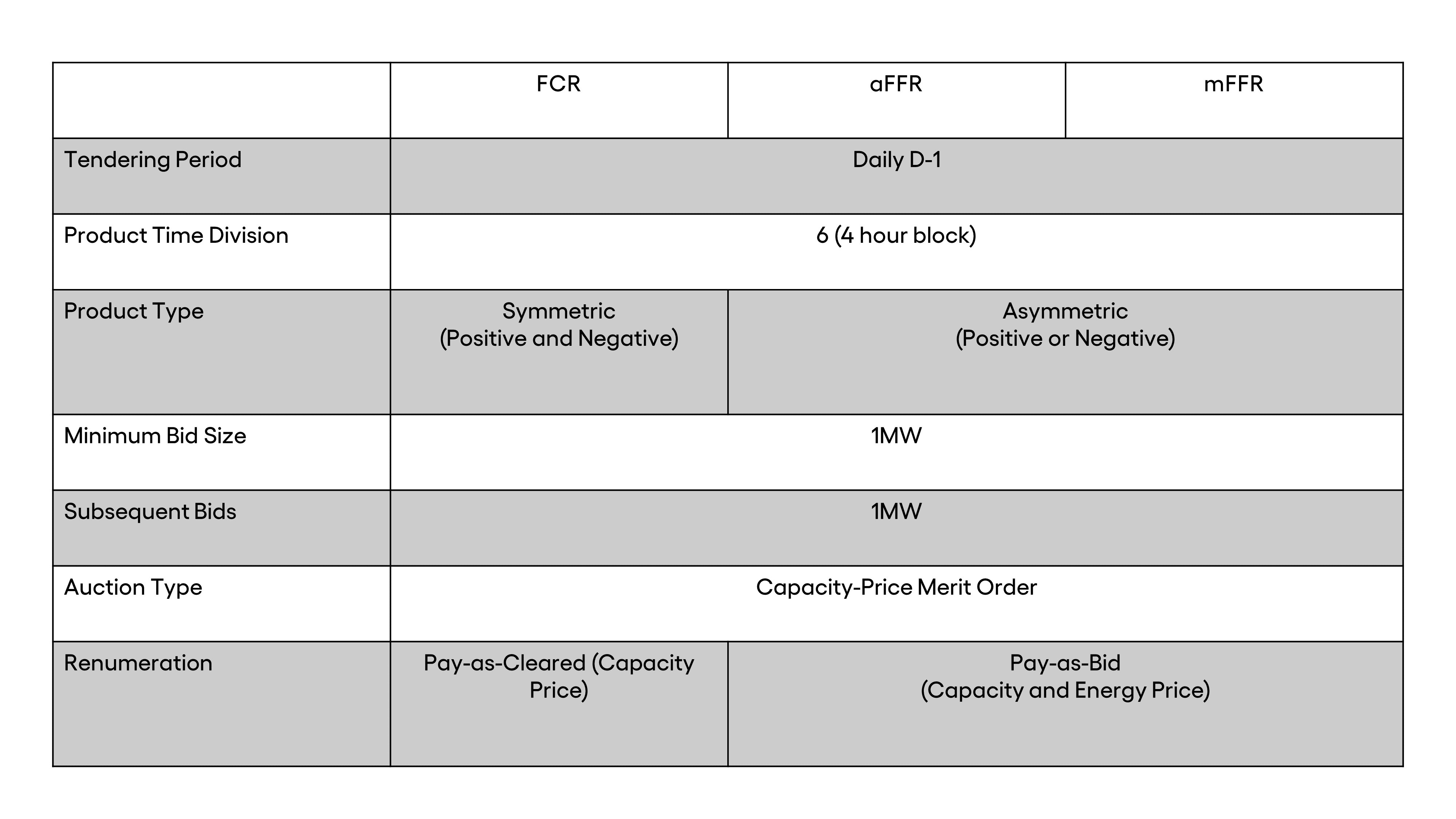

Under the current regulatory framework, the balancing reserves can be classified into four types, under three different processes based on the activation time of these reserves. These are, in decreasing order of time sensitivity (left to right):

In addition to generation units, controllable loads also participate in the balancing markets.

In 2010, Germany, due to its internal market design, initiated a coordination mechanism among its 4 TSOs for imbalance netting – called the GCC (Grid Control Cooperation). This has now evolved into a pan-European platform called IGCC (International Grid Control Cooperation) for TSOs connected to the continental Europe synchronous grid area.

Under this platform the available cross zonal transmission capacities after the intraday auctions are used for imbalance settlements among TSOs. This has enabled significant savings as only the reserves absolutely necessary for balancing are operated – reducing the balancing energy costs and improving welfare.

The price of imbalance settlement differs from country to country; however, the settlement is generally done on a pro-rata or weighted-average basis for the resources activated within a country.

For latest stats, please refer to: www.regelleistung.net.

German retail electricity markets are fully liberalized i.e. customers are free to choose their suppliers and contracts, and are able to change their suppliers whenever required. These consumers are generally connected to low and medium voltage networks and are served by a utility.

Similar to the transmission networks, the distribution networks are also regulated, with provision of third-party access. These networks are managed by Distribution System Operators (DSO) who technically have the same responsibilites as TSOs, except for balancing the grid.

Large or bulk consumers of electricity can also directly participate in the wholesale markets without the need of an additional service contact through a utility.

An operational geographical area where the electricity price is homogenous and no internal capacity constraints is considered. A bidding zone is under the management of a single Transmission System Operator (=TSO) and falls in their Control Area. The European Internal Energy Market is divided into several bidding zones with cross-zonal capacity available for technical and commercial reasons.

Geographical area where a single Transmission System Operator (=TSO) is responsible for operating and controlling the grid. Each TSO only operates in their respective control area.

A company responsible for operations, management, repairs and expansion of transmission system (high voltage infrastrucutre – 220/380 kVAC or HVDC ). Such companies operate under regulated monopolies under Germany and are required to allow non-prejudicial third-party access. TSO are also responsible for the stability of grid and procure balancing capacity to ensure reliable operations.

A company responsible for operations, management, repairs and expansion of distribtuion system (high to low voltage infrastructure). Such companies operate under regulated monopolies under Germany and are required to allow non-prejudicial third-party access.

European Legislation stipulates the establishment of Nominated Electricity Market Operators (NEMO) in either a competitive or monopolistic setting. These operators organize the electronic marketplaces where different market players can trade electricity during the allocated trading time. The trades can be based on auctions or continuous, pertinent to the exchange and/or the product.

In Germany multiple markets organize the day-ahead and intra-day markets, such as: EPEX Spot, EXAA and Nord Pool Spot.

The market participants with reserve-providing units or groups, providing their balancing capacities to the TSOs. These are powerplants meeting the technical pre-qualification criterion set by the TSOs.

An account is required for the physical deliveries of electricity. Each participant is responsible for balancing the demand and supply in their own portfolio. Each portfolio on the energy market has to be linked with one balancing account. These accounts are balanced on a quarter-hourly basis and incase of imbalances are penalized.

Trading electricity on the short-term markets is impossible without a balancing account.

Powerplants procured by the TSOs to provide additional capacity and balancing capabilities under the German framework. These are categorically old lignite coal-fired powerplants under standby in case of a contingency.

For a deep dive into the German energy sector as a whole, see our artcile covering The German Energy Sector: A Short Overview of Europe’s Leading Market.

These definitions are only for clarifications and does not necessarily provide or define their legal roles in the German electricity market. Please refer to the relevant regulations for the legal roles and responsibilities.